Buying a car is a big investment and car dealers often make the promise of “low interest” car finance to get customers in the door. But there’s always a catch…or two! Here are a few things to look out for when it comes to dealership finance offers and why it’s usually best to steer your customers clear of them. We don’t want to see them get taken for a ride by a dealership.

- There are many factors that contribute to dealership finance rates and each finance deal will be different

- There may be hidden fees and charges attached to the loan (always make sure you always read the small print in the contract)

- A 0% loan or low interest loan is usually limited to certain makes and models of cars eg. last year’s model or excess stock

- There may be a strict, shorter loan term – say three years, which will make your monthly repayments higher than if the term was five years

- Negotiation on the purchase price may be limited

- Sometimes the offer is only available to ABN holders

- You may not be able to structure the loan to suit your needs

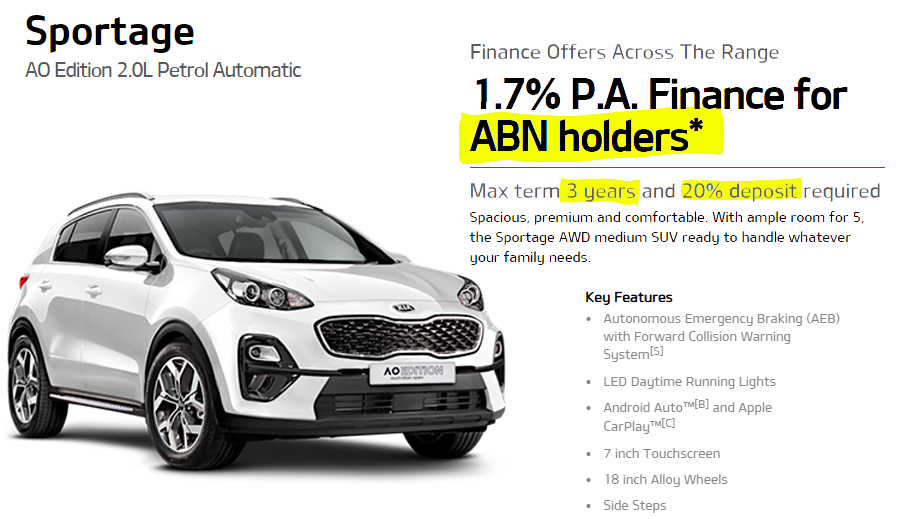

Kia Sportage 1.7% Finance Offer:

To demonstrate how the low interest offers sometimes work, we found this 1.7% p.a. ABN holder offer for a new Kia Sportage AO Edition Petrol Automatic. Sounds good, but in reality the monthly repayments are higher than they need to be. You will also notice a large deposit is required to enable the customer to qualify for this deal. The small print on their website states these conditions:

- Purchase price $30,990

- Maximum finance term of 3 years

- Minimum deposit of 20% is required = $6,198

- Nil balloon payment

- ABN holders only

- This equates to a monthly repayment of $705.86 per month

Platform Asset Finance Offer:

- We can offer up to a 5 year term (which most people take)

- We can offer a balloon of your choice

- No deposit required

- Rate available to ABN holders AND consumers

- Purchase price $30,990

- Commission to the broker $770 (inc GST)

- $30,990 over 5 years with a 20% balloon ($6,198)

- This equates to a monthly repayment of $496.25, or $588.96 with 0% balloon

That’s a difference of $209.61 per month when compared with Kia’s 1.7% finance offer. With our finance product, there is no need to come up with a cash contribution upfront. We can match the balloon to the value of the car at the end of the loan term OR the customer can pay the loan to NIL and retain the vehicle with outright ownership at the end of the loan term. The broker has the flexibility to structure the deal to best suit the customers’ needs.

Contact our Asset Finance Team on 1300 730 856 about how your brokerage can best compete against dealerships offers.